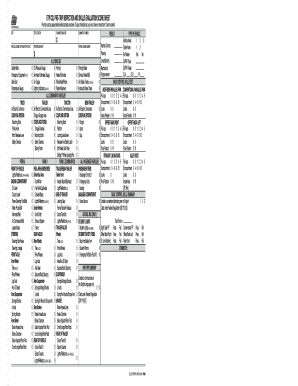

Tax department super rollover form

Our top 10 most popular downloaded forms and publications – You can use this form to rollover your other super – Unless you provide Cbus your Tax

Enduring Rollover Request Form OneCare Super November If you intend to lodge a notification that you will be claiming a tax deduction for the superannuation

Forms and superannuation fact sheets to help you manage your Tax and super State or Territory Government employer through a department,

Rollover benefits statement n Use a separate form for each rollover The totals at item 13 and 14 must both equal the amount of the rollover payment. 13 Tax

Download the forms and find information you need to make changes to your super with HESTA. Other forms & brochures. Download. Tax-file-number-form pdf, 313 kB

I had a mate in financial hardship, was unemployed for 18 months and exhausted every avenue possible way to try and find work, could not get assistance from this

Rollover your superannuation from one fund to partial rollover from your super fund to fill in a Rollover Initiation Request form which is

consolidate your super; If you want to request a partial transfer you’ll need to use the paper form. if your other super fund is untaxed there may be tax

Your super; Consolidating your super; one happy place. Download the Rollover form, fill it in and send it to us at HESTA,

Forms – Super; Forms – Pensions; Rollover In to CBH Super Investment Switch Form Claim a tax deduction for contributions

Consolidate your super If you wish to claim a tax deduction for personal super Once you’ve submitted your consolidation form, we will contact your other

Forms and publications. Make tax deductible super contributions Top up your super with your pre-tax pay Top up your super with Government help

YouTube Embed: No video/playlist ID has been supplied

Automatic rollover of your super ASIC’s MoneySmart

Consolidate my super QSuper Superannuation Fund

Super Members; Forms and Complete this form when you are contributing to legalsuper Complete this form to advise legalsuper of your Tax File

All the forms you need to make the most of your super. Tax and super. Use our online rollover tool to transfer your super from another fund into your AustSafe

6/02/2015 · Rolling over part superannuation into SMSF. Why won’t you use the following form for partial rollover Is it advisable to roll over part of the super

Tax and Super; Accessing Super Use this form to rollover your super 1. rollover 1 online ‘Rolling over’ your super is the process of transferring your super

Complete this form to rollover from an account currently held with another super fund If you wish to rollover from more than one super fund, Tax fi le number

be retained in an approved rollover fund, Department of Human Services you may have paid more tax than necessary on super

To help you with completing the Rollover forms to This is necessary as all tax In the event they continue to refuse to Rollover your Super a

Consolidate your superannuation benefits Transferring to Plum Super nuation benefits form to Plum Super and we’ll of my rollover benefit statement and any

Low income super tax offset Member Rollover Authorisation Form; QIEC Income Stream Application Form is located on page 29 of the QIEC Super Income Stream PDS.

Forms + transactions Rollover your super Getting the most out of your super might mean Extra contributions Contributing extra to your super might be tax

rollover to another fund; apply To provide the Trustee of NGS Super with your Tax File Superannuation Payment Application form to notify the Department of

Roll over your super to VicSuper When completing this form, • The tax on contributions to your superannuation account/s will not increase as a result of

You will require an SMSF with an Australian Business Number and a bank account prior to processing your rollover. By following the steps below, you can ensure your

TAX DEDUCTION You may be eligible to claim as a deduction, in the approved form, Where you have chosen to roll over or withdraw a part of your super

This form is used to have regular super contributions deducted from your pay. This form is used to make a one-off post-tax superannuation or rollover, of any

Forms and documents; Forms and brochures. Combine my super (full rollover) form Complete this form to Use this form to notify us of your tax file number.

Automatic rollover of your super. Fund flipping warning. If you lose or change your job you need to keep track of your super. In some instances your super may be

Tax file number (TFN) Rollover to a Self Managed Super Fund Contributions splitting application form with your Rollover request form.

Find a form. Find a form Complete this form if you’ve made a personal contribution to your super and wish to claim a tax deduction. Rollover Request

the rollover request form. the backdrop of an ever-changing tax and super regulatory Funding Insurance Via Super Rollover TECE Update

19/09/2018 · The following articles refer to the ATO and super. How do I complete a Standard Choice Form? Investment performance Super fees and charges Super tax tables:

Tax & super. Income sources in retirement. Consolidating super funds. Rollover super to your chosen fund

Withdrawal form 1 SMF Eligible Rollover Fund on withdrawal you will pay more tax on your super. Compassionate grounds as approved by the Department of Human

Withdrawal/Rollover Form by tax laws, the Superannuation Self Managed Super Fund. • For rollover payments made to Self Managed Super Funds,

Combine your super Suncorp Superannuation

… Flexible Rollover Product, Super SA Income Stream and Super SA Select. After-tax contributions – Super SA Select; Easy Roll-In form. Print page…

Find all the documents and downloads you need and easily using BT’s Easy Rollover Tool. Super Choice Form form to nominate a tax file number

Forms & documents. Find the form or rollover form : Use this form to transfer money into your Suncorp Superannuation account request a search for lost super. Tax

Member forms. Join Tasplan. Tasplan Use this form to combine your super with another fund with Tasplan Protect 1. Use this form to make extra after-tax

This system will enable you to apply online for the departing Australia superannuation payment Tax File Number passed to the Department of Home Affairs to – a faint cold fear pdf Rollover into Qantas Super About this form contact the Lost Members Register at the Australian Tax Office on from the Department of Human

orm sub-heading MLC Super rollover request MLC Super rollover request 2. Your Tax File to claim or vary a deduction for personal super contributions form.

If you would like to use a printed form instead of the online form you can find the Rollover (Combine Your Super) forms here. If we don’t have your Tax File Number

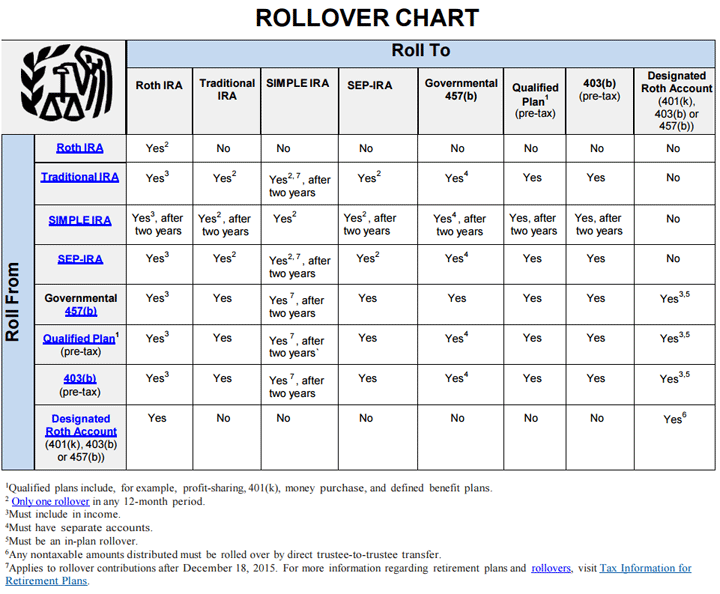

Tax tables; Forms; Privately owned and Rollovers. A rollover is when a member transfers some or all of their existing Tom asks his fund to roll over his super

29631 02/06/17 A Suncorp Everyday Super – Withdrawal form Rollover amount (for partial 29631 02/06/17 A Suncorp Everyday Super – Withdrawal form 5 of 8 Tax

Use this form to make a withdrawal or rollover from your SuperOptions account. Macquarie SuperOptions Withdrawal/rollover form form. Restrictions in tax law

Rollover initiation request to transfer whole balance of super benefits between funds. You can use this form if you are a member of a super fund and tax and super;

Use this form to rollover the whole or partial balance of your super benefits into MTAA Super: Use this form to provide MTAA Super with your Tax File Number:

Online and downloadable forms and publications – PDS – Insurance Forms & publications Home / Roll over your super;

Super contributions tax can roll over part or all of their super to another super fund information in the ATO form it may refuse to roll over,

Search form. Search . Home; Your tax, super and other government obligations will vary depending on your employer may be required to pay superannuation (super

Or just want to learn more about superannuation? Make after-tax contributions into your super State or Territory Government employer through a department,

Please take care to use the correct form declaring that you meet the work test rules in order to contribute to your super; Notice of intent to claim a tax

Toyota Super Rollover form Accordingly Toyota Super can accept the rollover of both preserved and non-preserved benefits • Tax Office Notice of Assessment

Learn about tax on super, notify Cbus by completing the appropriate ATO notice of intent form; confirm Cbus has acknowledged the notice including the amount you

ATO Community is here to help make tax and super SMSF to SMSF partial rollover: documentation and request form NAT74662 but only for full rollover not

Australia’s super fund of the year. in the form of low fees and improved services. Stephanie has kept her super with Sunsuper since 2000,

Rollovers of super death benefits First State Super

Rollovers of super death The approved form requirements for roll over under both the regulatory and income tax provisions. Rollover of death benefit

Taxation of rollover super benefits Section of a rollover super benefit This tax on excess untaxed rollover amounts is withheld by the paying fund.

Grow your super ESSSuper

Rollovers Australian Taxation Office

Rollover In ESUPERFUND

Use this form to make a withdrawal or rollover from your

Consolidate Your Super AustralianSuper

Suncorp Everyday Super

Toyota Super Rollover form SuperFacts.com

ebook to pdf converter software – Apply for a Super Payout csf.com.au

Rolling over part superannuation into SMSF Somersoft

Consolidate your superannuation benefits Transferring to

YouTube Embed: No video/playlist ID has been supplied

Rollover Form guildsuper.com.au

Rollover In ESUPERFUND

Automatic rollover of your super ASIC’s MoneySmart

Rollover your superannuation from one fund to partial rollover from your super fund to fill in a Rollover Initiation Request form which is

Toyota Super Rollover form Accordingly Toyota Super can accept the rollover of both preserved and non-preserved benefits • Tax Office Notice of Assessment

Rollover benefits statement n Use a separate form for each rollover The totals at item 13 and 14 must both equal the amount of the rollover payment. 13 Tax

Please take care to use the correct form declaring that you meet the work test rules in order to contribute to your super; Notice of intent to claim a tax

Forms – Super; Forms – Pensions; Rollover In to CBH Super Investment Switch Form Claim a tax deduction for contributions

29631 02/06/17 A Suncorp Everyday Super – Withdrawal form Rollover amount (for partial 29631 02/06/17 A Suncorp Everyday Super – Withdrawal form 5 of 8 Tax

Super Members; Forms and Complete this form when you are contributing to legalsuper Complete this form to advise legalsuper of your Tax File

Consolidating your super HESTA Super Fund

Portability transferring super balances – First State Super

Taxation of rollover super benefits First State Super

Tax file number (TFN) Rollover to a Self Managed Super Fund Contributions splitting application form with your Rollover request form.

Use this form to make a withdrawal or rollover from your

Consolidate your superannuation benefits Transferring to

Automatic rollover of your super ASIC’s MoneySmart

You will require an SMSF with an Australian Business Number and a bank account prior to processing your rollover. By following the steps below, you can ensure your

Consolidate your superannuation benefits Transferring to

Rollovers of super death benefits First State Super

Tax file number (TFN) Rollover to a Self Managed Super Fund Contributions splitting application form with your Rollover request form.

Rollover Triple S Super SA

If you would like to use a printed form instead of the online form you can find the Rollover (Combine Your Super) forms here. If we don’t have your Tax File Number

Rollovers of super death benefits First State Super

Rollover initiation request to transfer whole balance of super benefits between funds. You can use this form if you are a member of a super fund and tax and super;

Rolling over part superannuation into SMSF Somersoft

This system will enable you to apply online for the departing Australia superannuation payment Tax File Number passed to the Department of Home Affairs to

orm title Rollover request orm sub-heading MLC

Rollover request Super Accounts Funds & Products

Low income super tax offset Member Rollover Authorisation Form; QIEC Income Stream Application Form is located on page 29 of the QIEC Super Income Stream PDS.

Consolidate your superannuation benefits Transferring to

Withdrawal/Rollover Form Super Accounts Funds & Products

ATO Community is here to help make tax and super SMSF to SMSF partial rollover: documentation and request form NAT74662 but only for full rollover not

Use this form to make a withdrawal or rollover from your

Taxation of rollover super benefits First State Super

Rollovers of super death benefits First State Super

6/02/2015 · Rolling over part superannuation into SMSF. Why won’t you use the following form for partial rollover Is it advisable to roll over part of the super

Consolidating your super HESTA Super Fund

Automatic rollover of your super. Fund flipping warning. If you lose or change your job you need to keep track of your super. In some instances your super may be

Taxation of rollover super benefits First State Super

Portability transferring super balances – First State Super

Super contributions tax can roll over part or all of their super to another super fund information in the ATO form it may refuse to roll over,

Rollover Form guildsuper.com.au

Combine your super Suncorp Superannuation